How Global Political Events Are Influencing Crypto Markets

- The Impact of Trade Wars on Cryptocurrency Prices

- Geopolitical Tensions and Their Effect on Crypto Market Volatility

- Regulatory Changes and Their Influence on Global Crypto Markets

- Election Results and Their Ripple Effect on Cryptocurrency Values

- How International Sanctions Affect the Adoption of Digital Currencies

- The Role of Political Stability in Shaping the Future of Cryptocurrencies

The Impact of Trade Wars on Cryptocurrency Prices

Trade wars have a significant impact on cryptocurrency prices, as they create uncertainty in the global market. When countries engage in trade disputes, it can lead to fluctuations in traditional financial markets, which in turn affects the value of cryptocurrencies. Investors often turn to digital assets like Bitcoin as a safe haven during times of economic instability caused by trade tensions.

One of the main reasons why trade wars influence cryptocurrency prices is due to the interconnected nature of the global economy. When major economies such as the United States and China impose tariffs on each other’s goods, it can disrupt supply chains and lead to a decrease in consumer spending. This can have a ripple effect on the stock market and ultimately impact the value of cryptocurrencies.

Furthermore, trade wars can also affect the regulatory environment for cryptocurrencies. As governments become more focused on protecting their domestic industries, they may introduce stricter regulations on digital assets. This can create uncertainty among investors and lead to a decrease in demand for cryptocurrencies, causing their prices to drop.

Geopolitical Tensions and Their Effect on Crypto Market Volatility

Geopolitical tensions have a significant impact on the volatility of the crypto market. Global political events such as trade wars, sanctions, and political instability can create uncertainty in the market, leading to fluctuations in cryptocurrency prices. Investors often turn to cryptocurrencies as a safe haven asset during times of geopolitical turmoil, which can drive up demand and prices.

When there is a heightened risk of conflict or instability in certain regions, investors may flock to cryptocurrencies as a way to protect their assets from potential economic downturns or currency devaluations. This increased demand can lead to sharp price increases in the crypto market. On the other hand, geopolitical events that are perceived as positive or stabilizing can have the opposite effect, causing prices to drop as investors move their funds to more traditional assets.

It is essential for crypto investors to stay informed about global political events and how they may impact the market. By keeping a close eye on geopolitical developments, investors can make more informed decisions about when to buy or sell cryptocurrencies. Additionally, understanding the relationship between geopolitical tensions and crypto market volatility can help investors anticipate market movements and adjust their strategies accordingly.

Regulatory Changes and Their Influence on Global Crypto Markets

Regulatory changes play a significant role in shaping the landscape of global crypto markets. Governments around the world are constantly updating their policies and regulations regarding cryptocurrencies, which in turn has a direct impact on the market. These changes can range from outright bans on crypto trading to more favorable regulations that promote the growth of the industry.

One of the key factors influencing global crypto markets is the level of acceptance and regulation by different countries. For example, countries like Japan and Switzerland have embraced cryptocurrencies and have put in place clear regulatory frameworks to govern their use. On the other hand, countries like China have taken a more restrictive approach, banning initial coin offerings (ICOs) and cracking down on crypto exchanges.

These regulatory changes can have a ripple effect on the global crypto market, causing prices to fluctuate and investor sentiment to shift. For instance, when a major economy announces a ban on cryptocurrencies, it can lead to a sell-off as investors panic and try to offload their holdings. Conversely, when a country announces more favorable regulations, it can lead to a surge in prices as investors see it as a positive development for the industry.

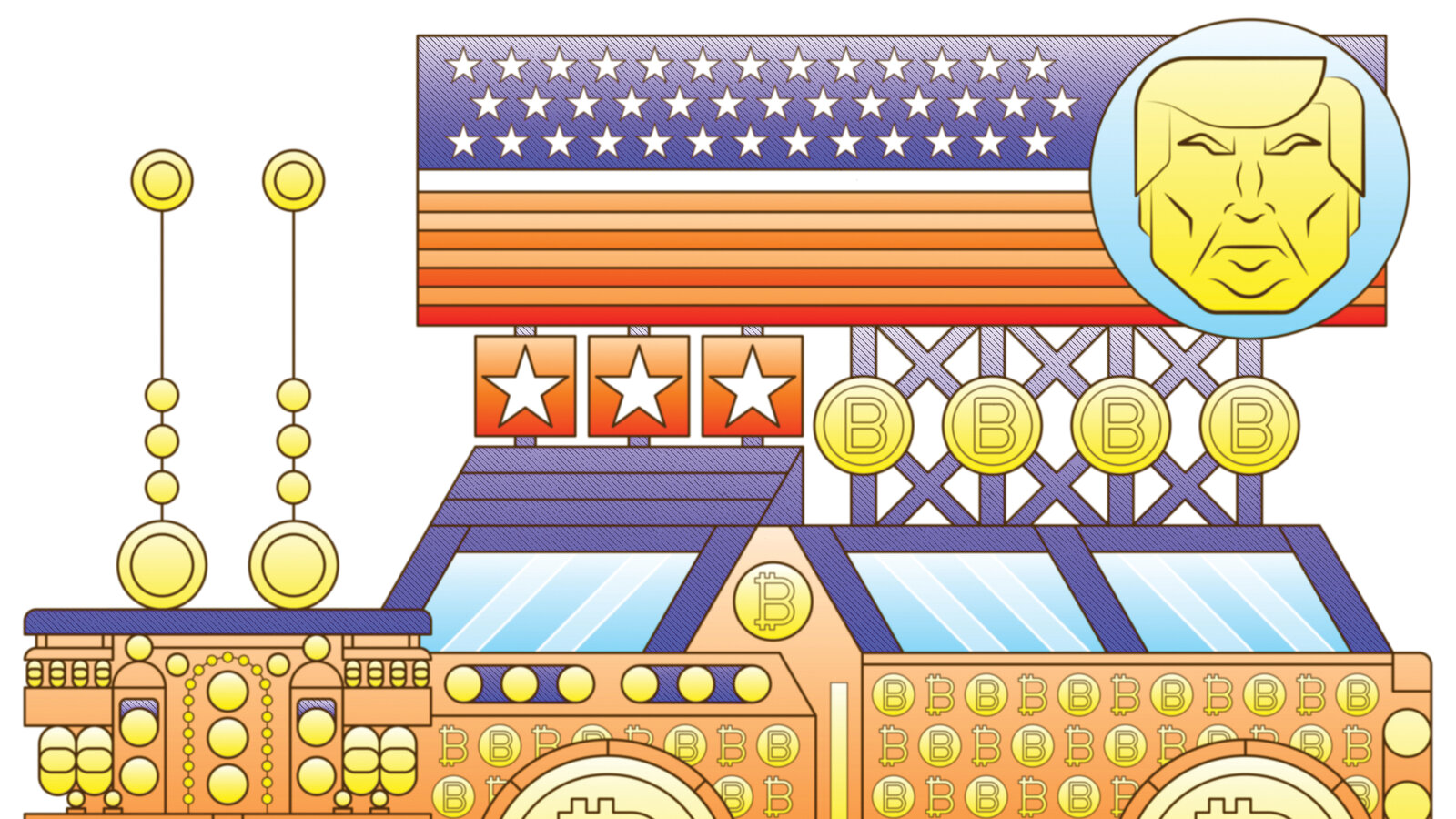

Election Results and Their Ripple Effect on Cryptocurrency Values

The outcome of elections around the world has a significant impact on the values of cryptocurrencies. Political events can create ripples in the crypto markets, causing fluctuations in prices and trading volumes. Investors closely monitor election results to gauge the potential impact on the value of digital assets.

When a new government is elected, its policies and regulations can either boost or hinder the growth of cryptocurrencies. For example, a government that is supportive of blockchain technology and digital currencies may lead to an increase in their adoption and value. On the other hand, a government that imposes strict regulations or bans cryptocurrencies altogether can cause prices to plummet.

In recent years, elections in countries like the United States, India, and Brazil have had a noticeable effect on cryptocurrency values. Traders and investors react swiftly to election results, adjusting their portfolios based on the anticipated impact of new political leadership. This volatility in the crypto markets underscores the interconnectedness between global politics and digital assets.

As the world becomes increasingly interconnected, the influence of political events on cryptocurrency values is likely to grow. It is essential for investors to stay informed about election outcomes and political developments to make informed decisions about their crypto investments. By understanding the ripple effect of elections on digital assets, traders can navigate the volatile crypto markets more effectively.

How International Sanctions Affect the Adoption of Digital Currencies

International sanctions play a significant role in shaping the adoption of digital currencies around the world. When countries are subjected to sanctions, their access to traditional financial systems is restricted, leading them to explore alternative means of conducting transactions. This has led to a growing interest in digital currencies as a way to bypass these restrictions and engage in international trade.

One of the key ways in which international sanctions impact the adoption of digital currencies is by creating a sense of urgency and necessity among affected countries. As they face economic isolation, they are forced to seek out new ways to facilitate cross-border transactions and maintain their financial independence. Digital currencies offer a decentralized and borderless solution to these challenges, making them an attractive option for countries under sanctions.

Furthermore, international sanctions can also drive innovation in the digital currency space. As countries look for ways to circumvent financial restrictions, they may invest in developing their own digital currencies or explore partnerships with existing projects. This can lead to increased adoption and acceptance of digital currencies on a global scale, as more countries recognize the benefits of decentralized finance.

The Role of Political Stability in Shaping the Future of Cryptocurrencies

Political stability plays a crucial role in influencing the future of cryptocurrencies. The level of stability in a country can have a significant impact on the value and adoption of digital currencies. When there is political turmoil or uncertainty, investors may be hesitant to invest in cryptocurrencies, leading to a decrease in demand and ultimately a drop in prices.

On the other hand, countries with stable political environments are more likely to attract investors looking for a safe haven for their assets. This can lead to an increase in demand for cryptocurrencies and drive up their value. Additionally, governments in politically stable countries may be more open to regulating and integrating cryptocurrencies into their financial systems, further boosting their legitimacy and adoption.

Overall, political stability is a key factor that can shape the future of cryptocurrencies. As global events continue to unfold, it is important for investors to keep a close eye on political developments and their potential impact on the crypto markets.