A Beginner’s Guide to Crypto Trading Terms

- Understanding the Basics of Cryptocurrency Trading

- Exploring Common Crypto Trading Terms

- Key Concepts Every Crypto Trader Should Know

- Demystifying Cryptocurrency Jargon for Beginners

- Essential Terminology for Getting Started in Crypto Trading

- Navigating the World of Cryptocurrency Trading Lingo

Understanding the Basics of Cryptocurrency Trading

Cryptocurrency trading can be a complex and volatile market for beginners to navigate. However, understanding the basics of how it works can help you make more informed decisions when buying and selling digital assets. One key concept to grasp is that cryptocurrencies are decentralized digital currencies that use cryptography for security. This means that they operate independently of a central authority, such as a government or financial institution.

When trading cryptocurrencies, you will often encounter terms like “exchange,” “wallet,” and “private key.” An exchange is a platform where you can buy and sell cryptocurrencies, similar to a stock exchange. A wallet is a digital tool that allows you to store your cryptocurrencies securely. Your private key is a unique code that gives you access to your wallet and should be kept confidential to protect your assets.

Another important aspect of cryptocurrency trading is understanding market trends and analysis. Just like traditional financial markets, the value of cryptocurrencies can fluctuate based on supply and demand, news events, and investor sentiment. Technical analysis involves studying price charts and patterns to predict future price movements, while fundamental analysis focuses on evaluating the underlying factors that drive the value of a cryptocurrency.

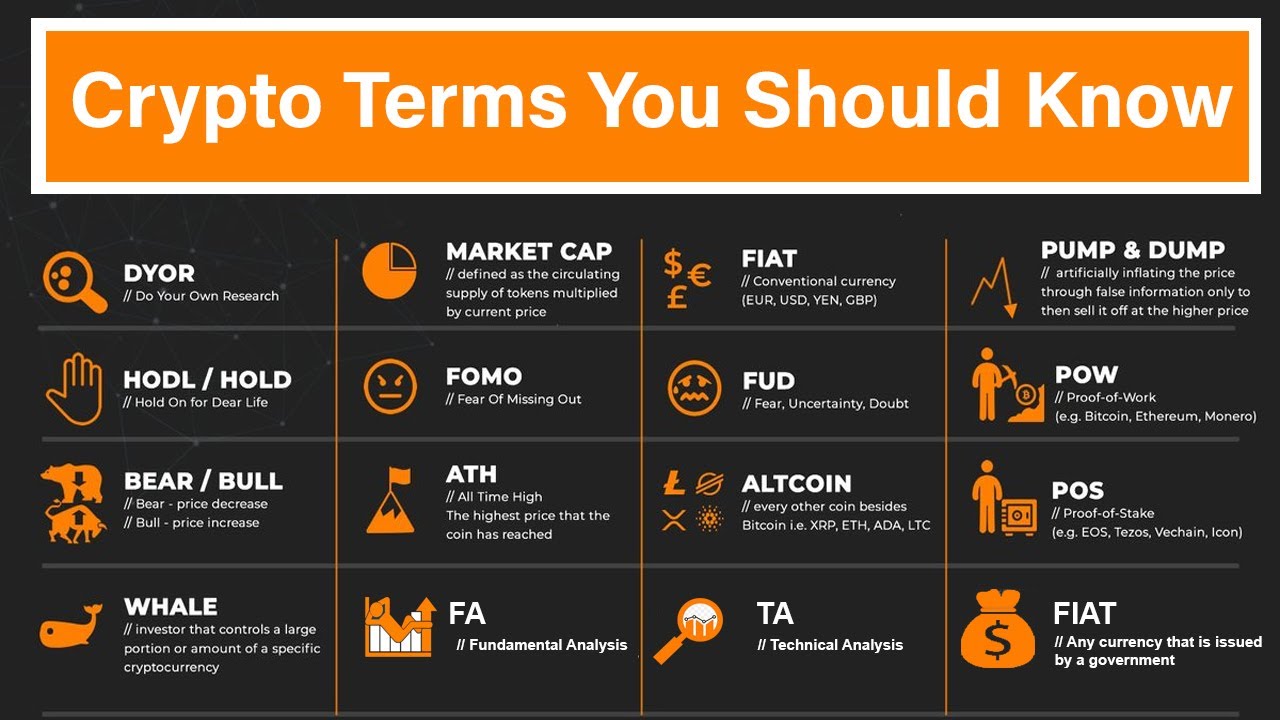

Exploring Common Crypto Trading Terms

When starting out in the world of crypto trading, it’s essential to familiarize yourself with some common terms that you will encounter frequently. Understanding these terms will help you navigate the market more effectively and make informed decisions. Here are some key crypto trading terms to explore:

- Altcoin: Refers to any cryptocurrency other than Bitcoin. Altcoins can vary widely in terms of technology, use case, and popularity.

- Blockchain: A decentralized, distributed ledger that records all transactions across a network of computers. Blockchain technology is the foundation of cryptocurrencies.

- FOMO: Fear of Missing Out. This term is used to describe the feeling of anxiety or regret that can arise from the fear of missing out on a profitable trade or investment opportunity.

- HODL: A misspelling of “hold” that has become a popular term in the crypto community. It refers to holding onto your cryptocurrency assets instead of selling them, even during market fluctuations.

- Liquidity: The ease with which an asset can be bought or sold in the market without causing a significant change in its price. High liquidity is desirable for traders.

- Market Cap: The total value of a cryptocurrency in circulation, calculated by multiplying the current price by the total number of coins in existence.

- Whale: A term used to describe an individual or entity that holds a large amount of cryptocurrency. Whales have the power to influence market prices with their trades.

By familiarizing yourself with these common crypto trading terms, you will be better equipped to engage in the exciting and dynamic world of cryptocurrency trading. Remember to continue learning and staying informed to make the most of your trading experience.

Key Concepts Every Crypto Trader Should Know

Understanding key concepts is essential for success in the world of crypto trading. Here are some important terms every trader should know:

- Cryptocurrency: Digital or virtual currencies that use cryptography for security.

- Blockchain: A decentralized, distributed ledger that records transactions across a network of computers.

- Wallet: A digital tool that allows you to store, send, and receive cryptocurrencies.

- Exchange: Platforms where you can buy, sell, and trade cryptocurrencies.

- Volatility: The degree of variation in the price of a cryptocurrency over time.

- Liquidity: The ease with which a cryptocurrency can be bought or sold without affecting its price.

- Market Cap: The total value of a cryptocurrency in circulation, calculated by multiplying the current price by the total supply.

- Altcoin: Any cryptocurrency other than Bitcoin.

- Fiat: Government-issued currency, such as the US dollar or Euro.

- HODL: A term derived from a misspelling of “hold,” referring to holding onto cryptocurrencies rather than selling them.

Demystifying Cryptocurrency Jargon for Beginners

Understanding the jargon associated with cryptocurrency trading can be overwhelming for beginners. However, it is essential to familiarize yourself with these terms to navigate the crypto market effectively. Here are some common terms demystified:

- Blockchain: This is a decentralized digital ledger that records all transactions across a network of computers.

- Wallet: A digital wallet is used to store, send, and receive cryptocurrencies. It is essential to keep your wallet secure.

- Altcoin: Any cryptocurrency other than Bitcoin is referred to as an altcoin.

- Fiat: Fiat currency is government-issued currency that is not backed by a physical commodity.

- HODL: This term originated from a misspelling of “hold” and is used in the crypto community to encourage holding onto your investments despite market fluctuations.

By familiarizing yourself with these terms, you will be better equipped to engage in cryptocurrency trading confidently. Remember to continue learning and staying informed about the latest trends in the crypto market to make informed decisions.

Essential Terminology for Getting Started in Crypto Trading

When starting out in the world of crypto trading, it is essential to familiarize yourself with the terminology used in this space. Understanding these key terms will help you navigate the market more effectively and make informed decisions. Here are some of the essential terms to get you started:

- Blockchain: A decentralized, distributed ledger technology that records transactions across a network of computers.

- Wallet: A digital tool that allows you to store, send, and receive cryptocurrencies.

- Exchange: A platform where you can buy, sell, and trade cryptocurrencies.

- Altcoin: Any cryptocurrency other than Bitcoin.

- Fiat: Government-issued currency, such as the US Dollar or Euro.

- Market Order: An order to buy or sell a cryptocurrency at the current market price.

- Liquidity: The ease with which an asset can be bought or sold in the market without affecting its price.

- Volatility: The degree of variation in the price of a cryptocurrency over time.

- HODL: A term derived from a misspelling of “hold,” referring to holding onto cryptocurrencies rather than selling them.

- Whale: An individual or entity that holds a large amount of cryptocurrency.

By familiarizing yourself with these essential terms, you will be better equipped to navigate the world of crypto trading and make informed decisions. Remember to continue learning and staying up to date with the latest trends and developments in the market to enhance your trading skills.

Navigating the World of Cryptocurrency Trading Lingo

When diving into the world of cryptocurrency trading, it’s essential to familiarize yourself with the various terms and phrases used by traders. Understanding this crypto trading lingo will help you navigate the market more effectively and communicate with other traders. Here are some common terms you may encounter:

- Altcoin: Any cryptocurrency other than Bitcoin is referred to as an altcoin. Examples include Ethereum, Ripple, and Litecoin.

- FOMO: Fear of Missing Out. This term is used to describe the feeling of anxiety that you might miss out on a profitable trade.

- HODL: A misspelling of “hold,” this term originated from a Bitcoin forum post and is now used to encourage traders to hold onto their investments instead of selling.

- Market Cap: The total value of a cryptocurrency in circulation, calculated by multiplying the current price by the total number of coins in circulation.

- Whale: A trader with a large amount of capital who can significantly influence the market by making large trades.

By familiarizing yourself with these terms and others commonly used in the cryptocurrency trading world, you’ll be better equipped to navigate the market and make informed decisions. Remember to stay up to date on the latest trends and news to stay ahead of the game.