Top 10 Cryptocurrencies by Market Capitalization

- Understanding the concept of market capitalization in the world of cryptocurrencies

- Exploring the top 10 cryptocurrencies dominating the market

- Analyzing the market trends of the leading cryptocurrencies

- Comparing the market capitalization of different cryptocurrencies

- Investing in the top cryptocurrencies for potential growth

- The impact of market capitalization on the value of cryptocurrencies

Understanding the concept of market capitalization in the world of cryptocurrencies

Cryptocurrencies have gained significant popularity in recent years, with many investors looking to capitalize on the potential returns they offer. One key concept to understand in the world of cryptocurrencies is market capitalization. Market capitalization, often referred to as market cap, is a measure of the total value of a cryptocurrency. It is calculated by multiplying the current price of a single coin by the total number of coins in circulation.

Market capitalization is an important metric as it gives investors an idea of the size and scale of a particular cryptocurrency. The higher the market cap, the more valuable the cryptocurrency is considered to be. This can influence investor sentiment and the overall perception of a cryptocurrency in the market.

When looking at the top 10 cryptocurrencies by market capitalization, it is important to consider not only the ranking of each cryptocurrency but also the factors that contribute to its market cap. Factors such as the technology behind the cryptocurrency, its use case, and the level of adoption can all impact its market capitalization.

Investors should also be aware that market capitalization can be a volatile metric, as it is influenced by factors such as price fluctuations and changes in circulating supply. It is important to conduct thorough research and due diligence before investing in any cryptocurrency based on its market capitalization alone.

Overall, understanding the concept of market capitalization is crucial for investors looking to navigate the world of cryptocurrencies. By considering market cap along with other key factors, investors can make more informed decisions when choosing which cryptocurrencies to invest in.

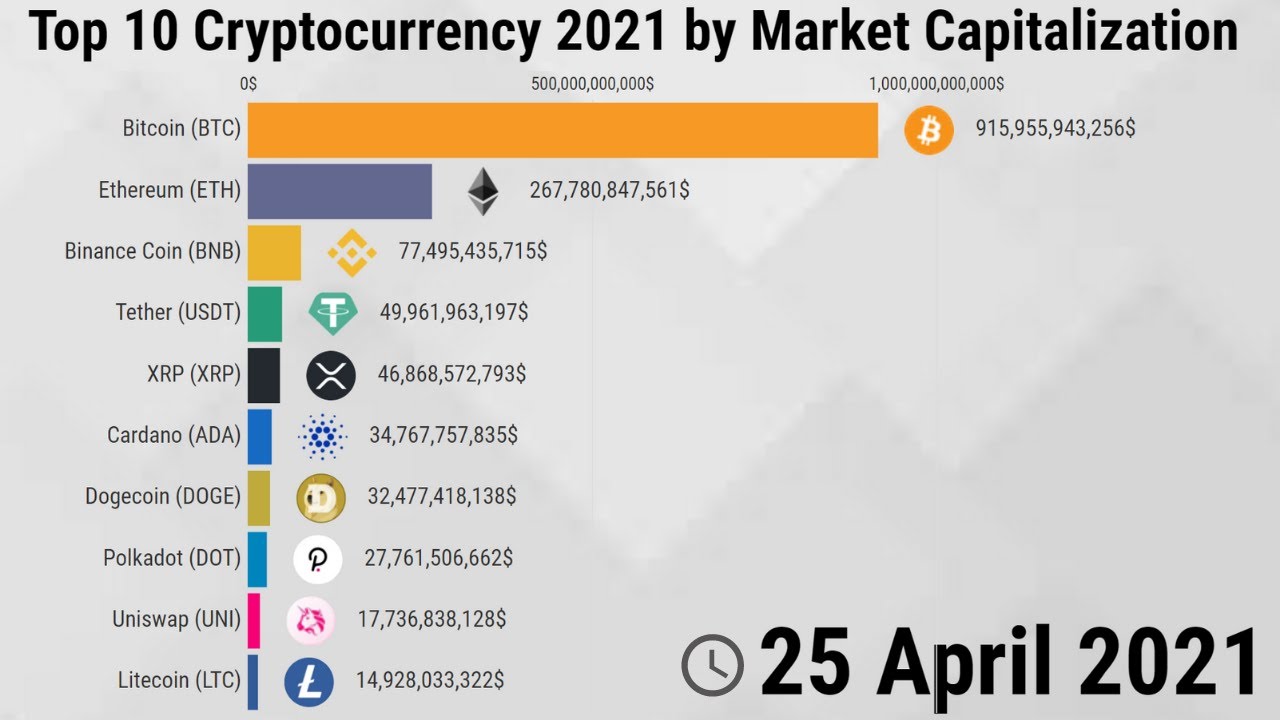

Exploring the top 10 cryptocurrencies dominating the market

The cryptocurrency market is a dynamic and ever-evolving space, with new digital assets emerging regularly. However, there are certain cryptocurrencies that have established themselves as the top players in the market based on their market capitalization. Let’s explore the top 10 cryptocurrencies dominating the market:

- Bitcoin (BTC): Bitcoin is the original cryptocurrency and continues to be the most dominant player in the market. Known for its decentralized nature and limited supply, Bitcoin has a loyal following of investors and enthusiasts.

- Ethereum (ETH): Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It has gained popularity for its innovative technology and large developer community.

- Binance Coin (BNB): Binance Coin is the native cryptocurrency of the Binance exchange, one of the largest cryptocurrency exchanges in the world. BNB is used to pay for trading fees on the platform and participate in token sales.

- Tether (USDT): Tether is a stablecoin that is pegged to the value of the US dollar. It is often used by traders as a safe haven during times of market volatility due to its price stability.

- Solana (SOL): Solana is a high-performance blockchain platform that aims to provide fast and scalable decentralized applications. It has gained popularity for its low transaction fees and high throughput.

- Cardano (ADA): Cardano is a blockchain platform that aims to provide a more secure and scalable infrastructure for the development of decentralized applications and smart contracts. It has a strong focus on sustainability and scalability.

- XRP (XRP): XRP is the native cryptocurrency of the Ripple network, which aims to facilitate fast and low-cost cross-border payments. It has gained traction among financial institutions for its speed and efficiency.

- Polkadot (DOT): Polkadot is a multi-chain blockchain platform that enables different blockchains to transfer messages and value in a trust-free fashion. It aims to provide a more scalable and interoperable network for decentralized applications.

- USD Coin (USDC): USD Coin is a stablecoin that is pegged to the US dollar and is issued by regulated financial institutions. It is often used for trading and as a store of value due to its price stability.

- Dogecoin (DOGE): Dogecoin started as a meme cryptocurrency but has gained mainstream adoption due to its active community and celebrity endorsements. It is often used for tipping and charitable donations.

Analyzing the market trends of the leading cryptocurrencies

The market trends of the top cryptocurrencies are constantly evolving, reflecting the dynamic nature of the digital asset space. Analyzing these trends can provide valuable insights into the performance and potential growth of these leading cryptocurrencies.

Bitcoin, as the pioneer cryptocurrency, continues to dominate the market with its high market capitalization and widespread adoption. Its price movements often set the tone for the entire cryptocurrency market, making it a key indicator for investors and traders alike.

Ethereum, known for its smart contract capabilities, has also seen significant growth in market capitalization. Its decentralized platform has enabled the creation of various decentralized applications (dApps) and decentralized finance (DeFi) projects, contributing to its popularity among developers and users.

Binance Coin, the native token of the Binance exchange, has emerged as one of the top cryptocurrencies by market capitalization. Its utility within the Binance ecosystem, including discounts on trading fees and participation in token sales, has driven demand for the token.

Other leading cryptocurrencies such as Cardano, Solana, and XRP have also experienced fluctuations in market capitalization, influenced by factors such as technological developments, regulatory news, and market sentiment. Analyzing these trends can help investors make informed decisions about their cryptocurrency portfolios.

Overall, the market trends of the top cryptocurrencies reflect the growing interest and adoption of digital assets in the global financial landscape. By staying informed and monitoring these trends, investors can navigate the volatile cryptocurrency market with greater confidence and strategic insight.

Comparing the market capitalization of different cryptocurrencies

When comparing the market capitalization of different cryptocurrencies, it is important to consider various factors that can influence their value. Market capitalization is calculated by multiplying the current price of a cryptocurrency by the total number of coins or tokens in circulation. This metric gives investors an idea of the overall size and worth of a particular cryptocurrency in the market.

Bitcoin, as the first and most well-known cryptocurrency, typically has the highest market capitalization among all cryptocurrencies. Its dominance in the market is often seen as a benchmark for the performance of other cryptocurrencies. Ethereum, the second-largest cryptocurrency by market capitalization, is known for its smart contract functionality and decentralized applications.

Other popular cryptocurrencies like Binance Coin, Cardano, and Solana have also gained significant market capitalization in recent years. These cryptocurrencies offer unique features and use cases that attract investors and users alike. It is important to research and understand the fundamentals of each cryptocurrency before investing, as market capitalization alone does not provide a complete picture of its potential for growth.

In conclusion, comparing the market capitalization of different cryptocurrencies can help investors make informed decisions about their investment portfolios. By considering factors such as the technology behind the cryptocurrency, its use cases, and market trends, investors can better assess the potential risks and rewards of investing in a particular cryptocurrency. It is essential to diversify investments and stay informed about the latest developments in the cryptocurrency market to make sound investment decisions.

Investing in the top cryptocurrencies for potential growth

Investing in the top cryptocurrencies can be a lucrative opportunity for potential growth in your portfolio. As the cryptocurrency market continues to evolve and expand, it is essential to consider the top 10 cryptocurrencies by market capitalization. These cryptocurrencies have shown resilience and stability in the market, making them attractive options for investors looking to diversify their holdings.

One of the top cryptocurrencies to consider is Bitcoin, which remains the most well-known and widely used digital currency. With its limited supply and widespread adoption, Bitcoin has the potential for long-term growth. Ethereum is another top cryptocurrency that offers smart contract capabilities and decentralized applications, making it a popular choice for developers and investors alike.

Ripple, also known as XRP, is a cryptocurrency that focuses on enabling fast and low-cost international money transfers. Its partnerships with major financial institutions have helped solidify its position in the market. Litecoin, often referred to as the silver to Bitcoin’s gold, offers faster transaction speeds and lower fees than its counterpart.

Other top cryptocurrencies to consider for potential growth include Cardano, Polkadot, Binance Coin, and Chainlink. These cryptocurrencies offer unique features and use cases that set them apart in the market. By diversifying your investment portfolio with a mix of these top cryptocurrencies, you can potentially capitalize on the growth opportunities presented by the evolving cryptocurrency market.

In conclusion, investing in the top cryptocurrencies by market capitalization can be a strategic move to position yourself for potential growth in the digital asset space. By carefully researching and selecting a mix of cryptocurrencies with strong fundamentals and market presence, you can build a diversified portfolio that aligns with your investment goals and risk tolerance. Remember to stay informed about market trends and developments to make informed investment decisions in this dynamic and evolving market.

The impact of market capitalization on the value of cryptocurrencies

The market capitalization of cryptocurrencies plays a significant role in determining their value in the digital asset space. Market capitalization is calculated by multiplying the current price of a cryptocurrency by the total number of coins or tokens in circulation. This metric is used to rank cryptocurrencies based on their size and overall worth in the market.

Cryptocurrencies with higher market capitalizations are often perceived as more stable and reliable investment options compared to those with lower market caps. Investors tend to gravitate towards cryptocurrencies with larger market capitalizations as they are seen as less volatile and less susceptible to market manipulation.

The value of a cryptocurrency can be influenced by various factors, including market demand, investor sentiment, regulatory developments, and technological advancements. However, market capitalization remains a key indicator of a cryptocurrency’s standing in the market and its perceived value by investors.

Investors should consider the market capitalization of a cryptocurrency when making investment decisions, as it can provide insights into the overall health and stability of the digital asset. While market capitalization is not the sole determinant of a cryptocurrency’s value, it is an important metric to consider when evaluating investment opportunities in the crypto space.