The Basics of Crypto Mining: How It Works

- What is Crypto Mining?

- The Role of Miners in the Cryptocurrency Ecosystem

- Understanding the Mining Process

- Types of Cryptocurrencies that Can be Mined

- Challenges and Risks of Crypto Mining

- The Future of Crypto Mining

What is Crypto Mining?

Crypto mining is the process of validating transactions and adding them to the public ledger known as the blockchain. Miners use powerful computers to solve complex mathematical puzzles that verify transactions. Once a miner successfully solves the puzzle, the new block of transactions is added to the blockchain, and the miner is rewarded with a certain amount of cryptocurrency.

Miners compete with each other to solve these puzzles, as the first one to do so is rewarded. This competitive aspect of mining is what ensures the security and integrity of the cryptocurrency network. The more miners there are, the more secure the network becomes.

One of the most popular cryptocurrencies to mine is Bitcoin, but there are many others as well. Each cryptocurrency has its own mining algorithm, which determines the type of hardware that can be used for mining. Some cryptocurrencies can be mined using regular CPUs, while others require specialized hardware known as ASICs.

Overall, crypto mining is a crucial part of the cryptocurrency ecosystem. It helps to secure the network, process transactions, and distribute new coins. While it can be a profitable venture for some, it also requires a significant investment in hardware and electricity. As the popularity of cryptocurrencies continues to grow, so does the importance of mining in supporting these digital assets.

The Role of Miners in the Cryptocurrency Ecosystem

The role of miners in the cryptocurrency ecosystem is crucial to the operation and security of blockchain networks. Miners are responsible for validating transactions, adding them to the public ledger, and securing the network against potential attacks. They play a vital role in maintaining the integrity and decentralization of cryptocurrencies.

Miners use powerful computers to solve complex mathematical puzzles in a process known as proof of work. This process requires significant computational power and energy consumption. Miners compete with each other to be the first to solve the puzzle and add a new block to the blockchain. In return for their efforts, miners are rewarded with newly minted coins and transaction fees.

Without miners, cryptocurrencies would not be able to function effectively. They ensure that transactions are processed quickly and securely, preventing double-spending and other fraudulent activities. Miners also help to distribute new coins into circulation, contributing to the overall growth and adoption of cryptocurrencies.

Understanding the Mining Process

The **mining process** in the world of cryptocurrency is a crucial aspect that ensures the security and integrity of the blockchain network. **Mining** involves validating transactions and adding them to the public ledger, known as the blockchain. This process requires **miners** to solve complex mathematical problems using computational power.

**Crypto mining** is a competitive process where **miners** compete to be the first to solve the mathematical problem and add a new block to the blockchain. The **miner** who successfully solves the problem is rewarded with newly minted coins as well as transaction fees. This process is known as **proof of work** and is essential for maintaining the decentralized nature of cryptocurrencies.

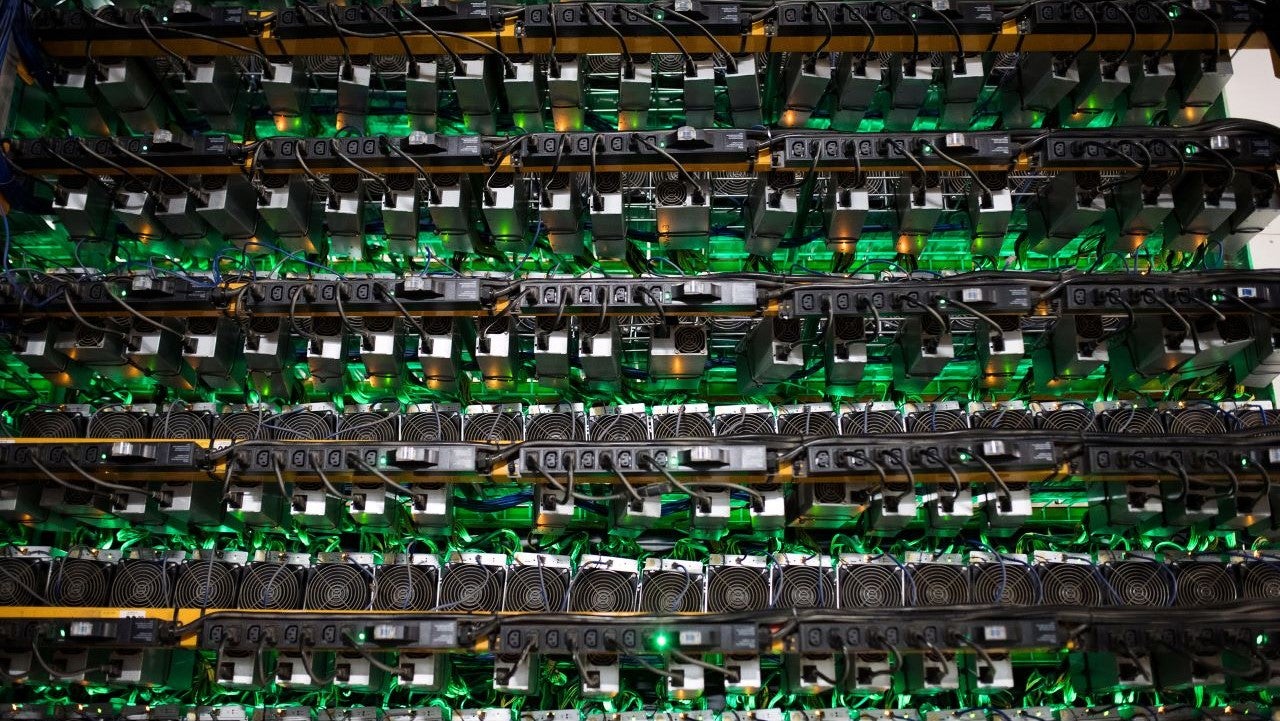

To participate in **crypto mining**, **miners** need specialized hardware such as ASICs (Application-Specific Integrated Circuits) or GPUs (Graphics Processing Units). These devices are optimized for performing the complex calculations required for **mining**. Additionally, **miners** need to join a **mining pool** to combine their computational power with other **miners** to increase their chances of successfully mining a block.

The **mining process** consumes a significant amount of electricity due to the computational power required to solve the mathematical problems. As a result, **mining** operations are often located in regions with cheap electricity to maximize profits. However, there is a growing concern about the environmental impact of **crypto mining** due to its high energy consumption.

In conclusion, **crypto mining** plays a vital role in securing the blockchain network and validating transactions. It is a competitive process that requires specialized hardware and significant computational power. While **mining** can be profitable, it also has environmental implications that need to be addressed in the future.

Types of Cryptocurrencies that Can be Mined

There are several **types** of cryptocurrencies that can be mined using different algorithms and methods. Some of the most popular cryptocurrencies that can be mined include Bitcoin, Ethereum, Litecoin, and Monero. Each of these cryptocurrencies has its own unique characteristics and mining process.

Bitcoin is the first and most well-known cryptocurrency that can be mined. It uses a proof-of-work algorithm called SHA-256, which requires miners to solve complex mathematical problems to validate transactions and create new blocks. **Mining** Bitcoin requires specialized hardware known as ASIC miners.

Ethereum is another popular cryptocurrency that can be mined using the Ethash algorithm. Ethereum mining involves solving cryptographic puzzles to validate transactions and create new blocks. Miners can use GPUs to mine Ethereum, making it more accessible to **individuals** with standard computer setups.

Litecoin is a peer-to-peer cryptocurrency that is based on the Scrypt algorithm. Litecoin mining is similar to Bitcoin mining but requires less computational power. This makes it a popular choice for **beginner** miners or those looking to mine cryptocurrencies without investing in expensive hardware.

Monero is a privacy-focused cryptocurrency that uses the CryptoNight algorithm for mining. Monero mining is designed to be ASIC-resistant, meaning it can be mined using standard CPUs and GPUs. This makes it a popular choice for **individuals** looking to mine cryptocurrencies without specialized hardware.

Challenges and Risks of Crypto Mining

Crypto mining comes with its fair share of challenges and risks that miners need to be aware of before diving into this activity. One of the main challenges is the high energy consumption associated with mining cryptocurrencies. The process of verifying transactions and adding them to the blockchain requires a significant amount of computational power, which in turn consumes a large amount of electricity. This can lead to high operating costs for miners, especially in regions where electricity prices are high.

Another challenge is the increasing level of competition in the mining space. As more miners join the network, the difficulty of mining new blocks increases, making it harder for individual miners to solve complex mathematical problems and earn rewards. This can result in smaller profits for miners and may even make mining unprofitable for some.

Additionally, there are risks associated with the volatility of cryptocurrency prices. The value of cryptocurrencies can fluctuate widely in a short period of time, which can impact the profitability of mining operations. Miners may find themselves in a situation where the cost of mining exceeds the value of the coins they are able to mine, leading to financial losses.

The Future of Crypto Mining

The future of crypto mining is constantly evolving as technology advances and the cryptocurrency market continues to grow. As more people become interested in mining cryptocurrencies, the industry is becoming more competitive. Miners are always looking for ways to increase their efficiency and profitability.

One trend that is gaining popularity in the world of crypto mining is the use of renewable energy sources. Many miners are turning to solar, wind, and hydroelectric power to reduce their energy costs and minimize their environmental impact. This shift towards sustainability is not only good for the planet but also helps miners save money in the long run.

Another development in the crypto mining industry is the rise of cloud mining services. Instead of investing in expensive hardware and setting up their own mining rigs, individuals can now rent computing power from cloud mining companies. This allows them to start mining cryptocurrencies without the hassle of maintenance and technical knowledge.

Furthermore, the future of crypto mining may also see the emergence of new mining algorithms and consensus mechanisms. As cryptocurrencies continue to innovate and improve their networks, miners will need to adapt to these changes to stay competitive. This could lead to new opportunities for mining different cryptocurrencies and earning rewards in alternative ways.