A Beginner’s Guide to Crypto Lending and Borrowing

- Understanding the Basics of Crypto Lending and Borrowing

- How to Get Started with Crypto Loans

- Exploring the Risks and Rewards of Crypto Lending

- Choosing the Right Platform for Crypto Borrowing

- Tips for Successful Crypto Lending and Borrowing

- Regulations and Compliance in the Crypto Lending Industry

Understanding the Basics of Crypto Lending and Borrowing

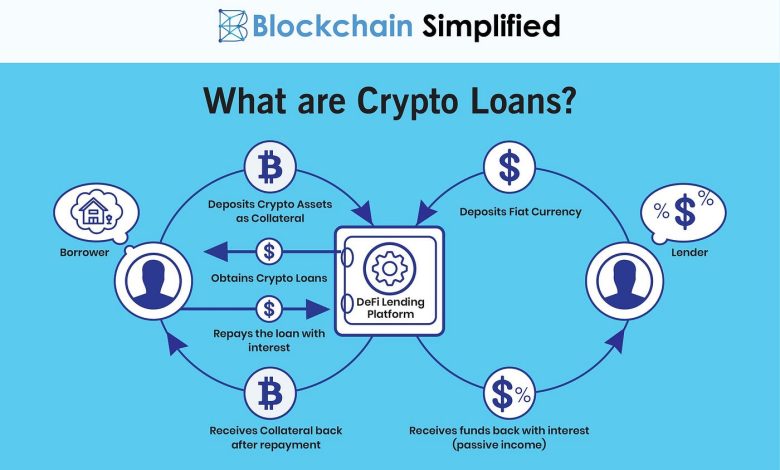

Crypto lending and borrowing are essential aspects of the cryptocurrency ecosystem that allow users to earn interest on their digital assets or borrow funds against their holdings. Understanding the basics of how crypto lending and borrowing work is crucial for anyone looking to participate in these activities.

When it comes to crypto lending, users can lend out their cryptocurrencies to other users or platforms in exchange for interest payments. This process is similar to traditional lending, where borrowers pay interest to lenders for the use of their funds. Crypto lending platforms facilitate these transactions by connecting lenders with borrowers and managing the loan agreements.

On the other hand, crypto borrowing allows users to borrow funds by using their cryptocurrencies as collateral. This means that borrowers can access liquidity without having to sell their digital assets. By locking up their crypto holdings as collateral, borrowers can receive a loan in the form of another cryptocurrency or stablecoin.

Both crypto lending and borrowing come with risks and rewards. Lenders can earn interest on their holdings but may be exposed to the risk of default by borrowers. Borrowers, on the other hand, can access funds quickly but must be mindful of the terms of the loan and the potential for liquidation if the value of their collateral drops below a certain threshold.

How to Get Started with Crypto Loans

To get started with **crypto loans**, the first step is to choose a reputable **crypto lending platform**. Look for platforms that offer **competitive interest rates** and have a **good reputation** in the **crypto community**. Once you have selected a platform, you will need to **create an account** and **complete the verification process**. This usually involves **providing some personal information** and **verifying your identity**.

After your account is set up, you can **deposit your cryptocurrency** into your **lending wallet** on the platform. Make sure to **read the terms and conditions** of the platform carefully before **depositing any funds**. Once your **crypto assets** are in your **lending wallet**, you can **start lending** them out to **borrowers** in exchange for **interest payments**.

If you are looking to **borrow cryptocurrency**, the process is similar. You will need to **choose a lending platform**, **create an account**, and **complete the verification process**. After that, you can **apply for a loan** by **specifying the amount** you want to borrow and **providing collateral**. Once your **loan application** is approved, the **funds will be deposited** into your **borrowing wallet**.

Overall, getting started with **crypto loans** is a **relatively straightforward process**. By **choosing the right platform**, **following the necessary steps**, and **being mindful of the risks involved**, you can **take advantage of the benefits** that **crypto lending and borrowing** have to offer.

Exploring the Risks and Rewards of Crypto Lending

When considering crypto lending, it is important to weigh the risks and rewards associated with this type of investment. While there is the potential for high returns in the form of interest payments from borrowers, there are also significant risks involved.

One of the main risks of crypto lending is the volatility of the cryptocurrency market. Prices can fluctuate dramatically in a short period of time, which can affect the value of the collateral provided by borrowers. If the value of the collateral drops below a certain threshold, lenders may not be able to recover their funds.

Another risk to consider is the security of crypto lending platforms. There have been instances of hacks and fraud in the crypto space, which can result in the loss of investor funds. It is important to thoroughly research and vet any platform before participating in crypto lending.

Despite these risks, there are also rewards to be gained from crypto lending. For lenders, the potential for high returns can be attractive, especially in a low-interest rate environment. Additionally, crypto lending can provide diversification to an investment portfolio.

In conclusion, while crypto lending can be a lucrative investment opportunity, it is important to be aware of the risks involved and to proceed with caution. By conducting thorough research and understanding the market, investors can mitigate some of the potential pitfalls of crypto lending.

Choosing the Right Platform for Crypto Borrowing

When it comes to choosing the right platform for crypto borrowing, there are several factors to consider. One of the most important things to look at is the interest rates offered by different platforms. Make sure to compare rates across various platforms to ensure you are getting the best deal.

Another crucial factor to consider is the loan-to-value ratio (LTV) that each platform offers. This ratio determines how much cryptocurrency you can borrow in relation to the value of the collateral you provide. It’s essential to find a platform with a reasonable LTV ratio to avoid overleveraging.

Additionally, consider the reputation and security measures of the platform. Look for platforms that have a good track record of security and have measures in place to protect your funds. Reading reviews and doing thorough research can help you determine the reliability of a platform.

Furthermore, take into account the variety of cryptocurrencies accepted as collateral on the platform. Having a diverse range of options can provide flexibility and allow you to use different assets as collateral.

Lastly, consider the terms and conditions of the platform, including repayment options and any fees associated with borrowing. Make sure you fully understand the terms before committing to a platform to avoid any surprises down the line.

Tips for Successful Crypto Lending and Borrowing

When engaging in crypto lending and borrowing, there are several tips to keep in mind to ensure a successful experience. Here are some key points to consider:

- Do thorough research on the platform you plan to use for lending or borrowing. Make sure it is reputable and has a good track record.

- Understand the terms and conditions of the lending or borrowing agreement. Pay attention to interest rates, repayment schedules, and any potential fees.

- Diversify your lending or borrowing portfolio to minimize risk. Avoid putting all your funds into a single loan or borrowing agreement.

- Stay informed about market trends and changes in the cryptocurrency industry. This will help you make informed decisions about when to lend or borrow.

- Consider using a crypto lending platform that offers additional security measures, such as insurance or collateral, to protect your funds.

By following these tips, you can increase your chances of success in the world of crypto lending and borrowing. Remember to always proceed with caution and only invest what you can afford to lose.

Regulations and Compliance in the Crypto Lending Industry

Regulations and compliance play a crucial role in the crypto lending industry. As the sector continues to grow, regulators are paying closer attention to ensure that platforms and users are following the necessary rules and guidelines. It is important for both lenders and borrowers to be aware of the regulatory environment in their respective jurisdictions to avoid any legal issues.

One of the key aspects of regulations in the crypto lending industry is the need for platforms to adhere to anti-money laundering (AML) and know your customer (KYC) requirements. These regulations are in place to prevent illicit activities such as money laundering and terrorist financing. Platforms are required to verify the identity of their users and report any suspicious transactions to the authorities.

Another important regulation in the crypto lending industry is the need for platforms to obtain the necessary licenses to operate legally. Depending on the jurisdiction, platforms may need to register with financial regulatory authorities or obtain specific licenses to offer lending services. Failure to comply with these regulations can result in fines or even the shutdown of the platform.